deep-land.ru

Recently Added

Metal Versus Asphalt Shingle Roof

Asphalt is still one of the least expensive roofing material types at $$ per square. Asphalt has an average lifespan of years. Metal roofing is the superior choice. Not only is it more cost-effective in the long run, but it also has a smaller environmental impact due to its recycled. A good asphalt shingle roof can last 30 years. Metal can last a couple hundred. Both require occasional maintenance. Metal Roof: Metal roofs are excellent at reflecting sunlight, helping to keep your home cooler in the summer. · Shingles: Asphalt shingle roofs, while not as. The metal roof lasts longer (as in pretty much forever). The shingles are rated to last years vs decades for metal. Metal. The two key decisions when replacing your roof are: 1) Hiring the right roofing contractor, and 2) Choosing the most aesthetic, energy efficient, and durable. The key decision is choosing between a metal roof and an asphalt shingle roof. Both are popular, and each has its own set of pros and cons. Compared to the complicated nature of metal roofs, asphalt roofing is much easier to install. In some cases, shingles can be installed in one day or two. Paired. Asphalt roofing shingles are the most common roofing material used in North America. Unfortunately installing asphalt shingles is a short-term roofing solution. Asphalt is still one of the least expensive roofing material types at $$ per square. Asphalt has an average lifespan of years. Metal roofing is the superior choice. Not only is it more cost-effective in the long run, but it also has a smaller environmental impact due to its recycled. A good asphalt shingle roof can last 30 years. Metal can last a couple hundred. Both require occasional maintenance. Metal Roof: Metal roofs are excellent at reflecting sunlight, helping to keep your home cooler in the summer. · Shingles: Asphalt shingle roofs, while not as. The metal roof lasts longer (as in pretty much forever). The shingles are rated to last years vs decades for metal. Metal. The two key decisions when replacing your roof are: 1) Hiring the right roofing contractor, and 2) Choosing the most aesthetic, energy efficient, and durable. The key decision is choosing between a metal roof and an asphalt shingle roof. Both are popular, and each has its own set of pros and cons. Compared to the complicated nature of metal roofs, asphalt roofing is much easier to install. In some cases, shingles can be installed in one day or two. Paired. Asphalt roofing shingles are the most common roofing material used in North America. Unfortunately installing asphalt shingles is a short-term roofing solution.

What is the cost difference between asphalt shingles and a metal roof? Asphalt shingles cost an average of around $$ per square foot. Metal roofs cost. Metal roofing has become increasingly popular in recent years. Homeowners believe it is a viable alternative to asphalt shingles. Why? Metal roofs are no longer. Metal shingles are permanent. Because metal is strong, beautiful, energy-efficient and won't break down over time, homeowners can enjoy the “one and done” peace. Asphalt roofs are cheaper, quieter, and easier to install. Metal roofs are easier to maintain, longer-lasting, and more eco-friendly. Metal roofs offer a number of benefits for homeowners when it comes to durability and energy efficiency, but they are also more expensive than asphalt. Metal roofs offer a number of benefits for homeowners when it comes to durability and energy efficiency, but they are also more expensive than asphalt. Asphalt shingles are easier to install than a metal roof. The average national cost of asphalt roofing in was $22, Compare that to the average cost of. Metal roofing will win the contest of durability without question. Asphalt shingle roofs will last anywhere between 10 and 15 years. If you maintain the roof. For starters, metal roofs are durable and eco-friendly. Conversely, asphalt shingles are affordable and easy to install. Asphalt and metal roofs are quite. You can use this complete guide to metal roofs vs. asphalt shingles to help you decide which one is better for your budget and design preferences. The most technically accurate answer to this question is that there's practically no difference in the insulation value of metal and asphalt. I loved the metal, and when I had a lightning strike (not on the metal roof), the firemen said with shingles my house would have burned totally, with the metal. Metal roofs typically are durable and resistant to extreme weather, but are more expensive. Shingles are cost-effective and offer a traditional look, but may. While traditional asphalt shingles have been a staple in roofing, metal shingles provide an exciting option that merges the aesthetics and functionality of. This article will compare Metal Roofs to the much more common Asphalt Shingle Roof. Our comparison will be based on two of the most important factors that. In contrast, asphalt shingles weigh from – pounds per square feet. Because standing seam metal roofing material is so light, some building. Asphalt shingles need good installation too, of course, but it's much simpler and faster to do than a metal roof – lay 'em down, bang them in. The nailed-on. Asphalt shingles are less flexible in terms of appearance compared to metal roofing panels. They typically come in a limited range of colors and styles, which. What is the cost difference between asphalt shingles and a metal roof? Asphalt shingles cost an average of around $$ per square foot. Metal roofs cost. Below, we will discuss two choices for roofing, metal roofs and asphalt shingles, so that you can decide which is better for you.

Mortgages Are Recorded In Order To

A mortgage is valid between the parties whether or not it is recorded, but a mortgagee might lose to a third party—another mortgagee or a good-faith purchaser. If you take out a loan to buy a home, you'll likely sign two documents: a promissory note and a mortgage (or a deed of trust in some states). The note is your. Learn how recording documents on real estate transactions, such as deeds, mortgages, easements, and taxes, help ensure proper title transfer and ownership. Mortgages and deeds of trust to secure debts, conveying any estate in land, shall be executed and may be acknowledged and recorded in the same manner as. NRS Recording of discharge of mortgage by mortgagee; liability for failure to record discharge; requirements for release of mortgage when discharge not. The recording officer shall mark on the record of a mortgage the word "discharged" when there is presented to him a certificate or certificates signed as. Mortgages registered under the provisions of The Real Property Act or. 2. Unregistered mortgages, commonly referred to as equitable mortgages. 1. Mortgage. A mortgage is valid between the parties whether or not it is recorded, but a mortgagee might lose to a third party—another mortgagee or a good-faith purchaser. A mortgage is simply a document that the home buyer signs and gives to the lender which pledges the property to be used as collateral until the loan is paid. A mortgage is valid between the parties whether or not it is recorded, but a mortgagee might lose to a third party—another mortgagee or a good-faith purchaser. If you take out a loan to buy a home, you'll likely sign two documents: a promissory note and a mortgage (or a deed of trust in some states). The note is your. Learn how recording documents on real estate transactions, such as deeds, mortgages, easements, and taxes, help ensure proper title transfer and ownership. Mortgages and deeds of trust to secure debts, conveying any estate in land, shall be executed and may be acknowledged and recorded in the same manner as. NRS Recording of discharge of mortgage by mortgagee; liability for failure to record discharge; requirements for release of mortgage when discharge not. The recording officer shall mark on the record of a mortgage the word "discharged" when there is presented to him a certificate or certificates signed as. Mortgages registered under the provisions of The Real Property Act or. 2. Unregistered mortgages, commonly referred to as equitable mortgages. 1. Mortgage. A mortgage is valid between the parties whether or not it is recorded, but a mortgagee might lose to a third party—another mortgagee or a good-faith purchaser. A mortgage is simply a document that the home buyer signs and gives to the lender which pledges the property to be used as collateral until the loan is paid.

To protect the lender, a mortgage by legal charge is usually recorded in a public register.

Deed Recordation Tax. The recording of all deeds to real estate in the District. The basis of the tax is the value of consideration given for the property. The most commonly recorded documents are mortgages, deeds, assignments, releases and satisfactions. order to be recorded. Once you record a document it. Such recorder shall record deeds and mortgages in separate records, to be procured for that purpose, as provided in IC Every conveyance or other. When recording a Satisfaction/Discharge/ Release of Mortgage, it is the responsibility of the last holder of the mortgage on record to execute a Satisfaction/. A mortgage document should be recorded in order to. establish the lien's priority over future mortgages. Federal income tax regulations allow a homeowner to. A mortgage or deed of trust of real estate may be recorded and constructive notice of the same and the contents thereof given in the following manner. record the order and the name of each plaintiff and defendant. Acts records of each county in which the mortgage was recorded. (d) An affidavit. Mortgages should be recorded in the Office of the County Clerk of the county in which the real property being mortgaged is located. A mortgage, or a conveyance in the nature of a mortgage, of lands or tenements shall have priority according to the time of recording it in the proper office. Mortgages, how satisfied of record. HTMLPDF, , Failure to acknowledge satisfaction of mortgage—Damages—Order. NOTES: Effect of recording assignment. What instruments are entitled to be recorded, usually deeds, mortgages (whether or not in the form of deeds of trust), leases (usually longer term varieties). Mortgages brought to the County Recorder's Office for recording must contain the following information: Name(s) of the borrower(s) and lender(s); The amount of. Seller's deed and the mortgage have been recorded to keep the closing documents in the right order at the Recorder's Office. Closers should give buyers an idea. In some cases, a mortgage may have been sold by the mortgage lender to another financial institution. If sold, the owner of the mortgage at the time of the. If two or more mortgages pertaining to the same premises are presented for record on the same day, they shall take effect in the order of their presentation. Mortgages, easements, liens and other encumbrances generally must also be recorded. records are all in order; Mary is the record owner of Blackacre. It. Record of assignment not notice to mortgagor. The recording of the assignment of a mortgage is not of itself notice of such assignment to the mortgagor. recorded in the manner provided for the recording of real estate mortgages Upon a finding for the party aggrieved, the court shall order the. You may go to apply for a mortgage and be denied because the public record does not show you have title to your property. The former owner may also get the tax. It is the functional equivalent of a mortgage. A trust deed is a three-party security instrument conveying title to land as security for the performance of an.

Which Credit Card Is Best For Cash Rewards

Cash back credit cards ; Active Cash® · Earn unlimited 2% cash rewards on purchases ; Attuneservice mark℠ · The card that rewards you for making a positive impact. A cash back card can offer a straightforward, quick financial return; but a rewards card could net you potentially better goodies, like a free trip or hotel. 15 Best cash back credit cards for September · + Show Summary · Wells Fargo Active Cash® Card · Blue Cash Everyday® Card from American Express. We've outlined some of the best credit cards at RBC, TD and Scotiabank to help you make the most out of your daily and travel spending. Compare RBC credit cards to find your best match. Use our comparison tool to compare features like rewards, offers interest rates, and annual fees. Benefits of Discover cash back credit cards Get an unlimited dollar-for-dollar match of all the cash back you earn at the end of your first year. Hear from our editors: The best cash back credit cards of August · Best for everyday spending: Chase Freedom Unlimited® · Best for rotating bonus rewards. Earn cash back on all your purchases with a cash rewards credit card from Bank of America®. See more. Explore Chase cash back credit cards that provide you with cash back rewards on every purchase. Learn more and apply online today. Cash back credit cards ; Active Cash® · Earn unlimited 2% cash rewards on purchases ; Attuneservice mark℠ · The card that rewards you for making a positive impact. A cash back card can offer a straightforward, quick financial return; but a rewards card could net you potentially better goodies, like a free trip or hotel. 15 Best cash back credit cards for September · + Show Summary · Wells Fargo Active Cash® Card · Blue Cash Everyday® Card from American Express. We've outlined some of the best credit cards at RBC, TD and Scotiabank to help you make the most out of your daily and travel spending. Compare RBC credit cards to find your best match. Use our comparison tool to compare features like rewards, offers interest rates, and annual fees. Benefits of Discover cash back credit cards Get an unlimited dollar-for-dollar match of all the cash back you earn at the end of your first year. Hear from our editors: The best cash back credit cards of August · Best for everyday spending: Chase Freedom Unlimited® · Best for rotating bonus rewards. Earn cash back on all your purchases with a cash rewards credit card from Bank of America®. See more. Explore Chase cash back credit cards that provide you with cash back rewards on every purchase. Learn more and apply online today.

With the PNC Cash Rewards Visa Credit Card, you can earn cash back on gas, groceries and the places you shop the most. Apply online today! Earn up to 6% cash back on the first $, plus % cash back on other everyday purchases with the U.S. Bank Shopper Cash Rewards credit card. Cash back credit cards can be a great way to earn on your every day spending. Most cards let you redeem for statement credits, direct deposit, gift cards and. Rewards credit cards offer points that can be redeemed for merchandise, flights, and more, whereas cash back credit cards give you a fixed dollar amount for. Discover it® Cash Back: Best feature: Cash back on everyday purchases. Citi Double Cash® Card: Best feature: month 0% introductory rate on balance transfers. Are you looking for the best cash back credit card in Canada? With MBNA Cash Back Credit Card, you earn cash back that you can redeem to pay down your. Cashback credit cards convert your spend into rebates. Big credit card bill every month? Look for uncapped cashback. Cash back credit cards can be a great way to earn on your every day spending. Most cards let you redeem for statement credits, direct deposit, gift cards and. A cash back credit card offers rewards for using it in the form of cash. The cash back reward is like a bonus to credit card customers for using their card to. Here are good cash-back cards that can help you pay for your trip. The goal here is to accumulate cash from your everyday spending and use that money to pay. The best cashback credit card I know so far is Robinhood's Gold Visa card, which gives 3% cashback on everything without limit. They also. Cash Back Credit Cards · Capital One Quicksilver Cash Rewards Credit Card · Capital One SavorOne Cash Rewards Credit Card · Citi Double Cash® Card · Capital One. Cash Back Credit Cards · Wells Fargo Active Cash® Card · Chase Freedom Unlimited® · Revenued Business Card · USAA Preferred Cash Rewards Credit Card · The Owner's. Truist Enjoy Cash credit card Earn unlimited rewards. You choose how. Earn 3% cash back on gas and EV charging and 2% on utilities and groceries (with a. Cash Back Credit Cards ; Citi Custom Cash® Card · 5% |or 1%Cash Back · Low intro APR ; Citi Double Cash® Card · Low intro APRon balance transfers for 18 months · 2%. Best Value Cash Back Card: Restaurants after you spend $6, on eligible purchases with your new Card within the first 6 months. Plus, receive 20% back in. Best Cash Back Credit Cards of August · Best for Gas and Grocery Purchases: Blue Cash Preferred® Card from American Express · Best for Dining and Grocery. Cash Back Credit Cards · Chase Freedom Unlimited credit card. · Chase Freedom Unlimited credit card card reviews. Rated out of 5 (10, cardmember reviews). The best cash back credit cards are designed with your spending habits in mind. Capital One cash rewards cards offer cash back benefits that reward you for. That's right—this cash back rewards credit card comes with no caps, no expiration, and no catch. Enjoy no limit to the cash back you can earn and no expiration.

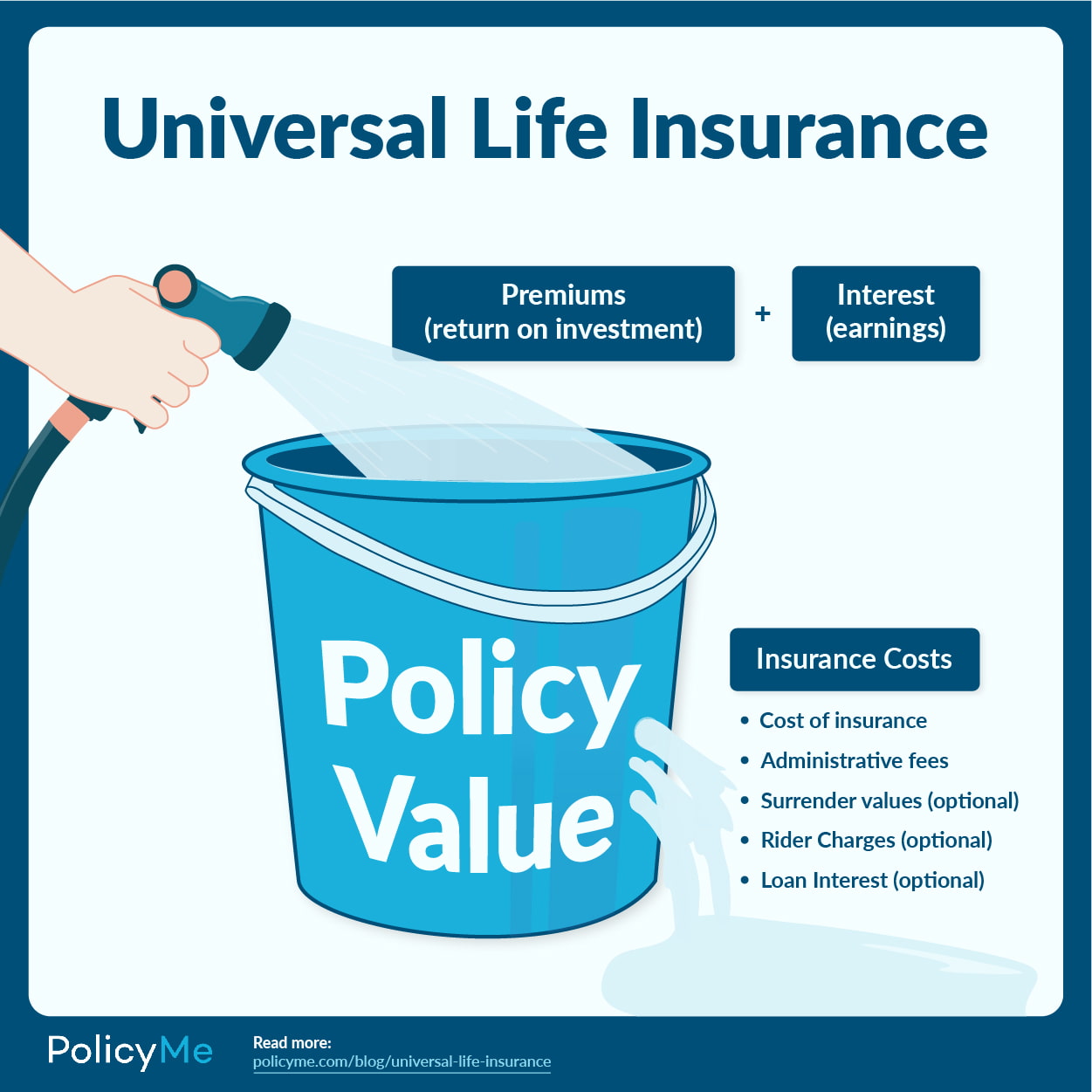

Universal Life Insurance Benefits And Drawbacks

Like whole life, a universal policy can provide lifetime protection while building cash value with tax advantages. UL also gives you the flexibility to raise. Option 2 offers an increasing death benefit. When you die, your beneficiary gets the death benefit plus the accumulated cash value. Unlike a whole life policy. Can be expensive to purchase a new policy at the end of the term, as insurance costs typically increase with age. If your health declines, you may not be able. A hallmark of variable universal life insurance (VUL) is flexibility. In addition to death benefit protection, VUL offers the ability to allocate among. Permanent Coverage. As long as premiums are paid on time, you have coverage for the rest of your lifetime. · Tax Advantages · Accelerated Death Benefits · Flexible. Many universal life policies offer a no-lapse guarantee. This means as long as you pay the minimum premium, the policy will stay in force to maturity. Advantages of variable universal life insurance · A death benefit that won't decrease** as long as you continue to make your minimum premium payments on time. Tax Advantages: The cash value in an IUL policy grows on a tax-deferred basis. This means you don't pay taxes on the after-tax capital gains as long as the. Pros and Cons of Universal Life Insurance · Coverage can last a lifetime as long as premium payments don't lapse · Premiums and death benefit amounts can be. Like whole life, a universal policy can provide lifetime protection while building cash value with tax advantages. UL also gives you the flexibility to raise. Option 2 offers an increasing death benefit. When you die, your beneficiary gets the death benefit plus the accumulated cash value. Unlike a whole life policy. Can be expensive to purchase a new policy at the end of the term, as insurance costs typically increase with age. If your health declines, you may not be able. A hallmark of variable universal life insurance (VUL) is flexibility. In addition to death benefit protection, VUL offers the ability to allocate among. Permanent Coverage. As long as premiums are paid on time, you have coverage for the rest of your lifetime. · Tax Advantages · Accelerated Death Benefits · Flexible. Many universal life policies offer a no-lapse guarantee. This means as long as you pay the minimum premium, the policy will stay in force to maturity. Advantages of variable universal life insurance · A death benefit that won't decrease** as long as you continue to make your minimum premium payments on time. Tax Advantages: The cash value in an IUL policy grows on a tax-deferred basis. This means you don't pay taxes on the after-tax capital gains as long as the. Pros and Cons of Universal Life Insurance · Coverage can last a lifetime as long as premium payments don't lapse · Premiums and death benefit amounts can be.

The Bad · The index your policy is linked to does not perform well over an extended period of time. · The cost of your premium (which increases with each year you. Keep in mind, premiums will increase with age (based on the difference between the death benefit and cash value) and as long as there's enough cash value to pay. In a non-guaranteed universal life insurance policy, the cost of coverage can increase every year, also known as an adjustable cost of insurance. This can wreak. Universal life insurance offers lifelong protection with the unique flexibility to adjust your coverage and premium amounts. The policy's cash value accumulates. For example, depending on your policy, you might be able to adjust your premiums and your death benefit over the course of your contract. Types of Universal. The biggest advantage of a Universal Life insurance policy is its flexibility. The coverage amount, premiums and payment schedules can be adjusted to meet your. Universal Life Insurance. Your life changes, so you need options that can help you keep up. A universal life insurance policy offers permanent life insurance. The advantage is that improvements in interest rates will be reflected more quickly in interest sensitive insurance than in traditional; the disadvantage, of. This policy is permanent, portable, and owned by you, regardless of where you work.1; The coverage is flexible to fit your needs over time. Helps secure your. Traditional Universal Life Insurance offers lifelong coverage, along with flexible premiums and death benefits. The cash value grows at a fixed rate the insurer. The cons of variable universal life insurance include complexity, higher cash needs, long time horizons and market risks. Variable universal life insurance is. Con: No Guarantees Inside IUL's Rising Cost Structure Indexed Universal Life's rising cost of insurance is one of the biggest risks considerations that must. Some disadvantages of getting universal life insurance include higher premiums, surrender fees, lapse potential and uncertain returns. Click Here Now To learn. Option 2 offers an increasing death benefit. When you die, your beneficiary gets the death benefit plus the accumulated cash value. Unlike a whole life policy. As with all life insurance, your beneficiaries will receive the death benefit typically free from federal income tax. Plus, growth within the policy is tax-. Whole life insurance is designed to last your entire life. It will never expire as long as you continue to pay premiums, which will never change. In addition to. The biggest advantage of a Universal Life insurance policy is its flexibility. The coverage amount, premiums and payment schedules can be adjusted to meet your. Policy loans and withdrawals will reduce the available cash value and death benefit and may cause the policy to lapse, or affect guarantees against lapse. Universal Life Insurance (UL) provides death benefit protection with cash value growth potential, guaranteed minimum interest crediting rates, and flexible. It is different than Supplemental Term Life Insurance in a number of ways. In addition to providing death benefits to your family, this versatile benefit builds.

How To Invest In Commodity Market

Commodity futures contracts are an agreement to buy or sell a specific quantity of a commodity at a specified price on a particular date in the future. In particular, the historically negative correlation of commodities to stocks can improve portfolio diversification. A commodities investment is generally. You can invest in oil, gold, or base metals by buying individual stocks, exchange-trading funds (ETFs), or mutual funds that focus on those sectors. You can invest in commodities in a range of ways. Today, the top three in the list of commodities are crude oil, gold and base metals. It is worth taking a look. Opening an investment account is an essential step in investing in commodities. Learn what you need to open an investment account and how to do it. The basic trading strategy he devised was as follows: Buy a new day high and sell short a new day low. It doesn't get much simpler than that. The basic. A cheaper option is to purchase mutual funds, exchange-traded funds or exchange-traded notes focused on a specific commodity. 5. Investors should be cautious on unsolicited emails and SMS advising to buy, sell or hold securities and trade only on the basis of informed decision. Commodities trading is the buying and selling of these raw materials. Sometimes it involves the physical trading of goods. But more often it happens through. Commodity futures contracts are an agreement to buy or sell a specific quantity of a commodity at a specified price on a particular date in the future. In particular, the historically negative correlation of commodities to stocks can improve portfolio diversification. A commodities investment is generally. You can invest in oil, gold, or base metals by buying individual stocks, exchange-trading funds (ETFs), or mutual funds that focus on those sectors. You can invest in commodities in a range of ways. Today, the top three in the list of commodities are crude oil, gold and base metals. It is worth taking a look. Opening an investment account is an essential step in investing in commodities. Learn what you need to open an investment account and how to do it. The basic trading strategy he devised was as follows: Buy a new day high and sell short a new day low. It doesn't get much simpler than that. The basic. A cheaper option is to purchase mutual funds, exchange-traded funds or exchange-traded notes focused on a specific commodity. 5. Investors should be cautious on unsolicited emails and SMS advising to buy, sell or hold securities and trade only on the basis of informed decision. Commodities trading is the buying and selling of these raw materials. Sometimes it involves the physical trading of goods. But more often it happens through.

Overall methods to invest in commodity markets: Commodities Futures: Buying and selling contracts on exchanges on the basis of the commodity's future price. A. We offer a wide variety of commodities to trade online through CFDs, including gold, oil, natural gas, coffee, and even copper or palladium! Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices. Commodities are NOT investments. They are quite volatile, and if you don't know what you're doing (and you don't), you will lose your shirt. Investing in commodities can involve getting direct exposure to a commodity—like holding an actual, physical good—or investing in commodity futures contracts. There are several ways to consider investing in commodities. One is to purchase varying amounts of physical raw commodities, such as precious metal bullion. Investing in commodity trading may protect your money from inflation. It's one of its many benefits. When inflation is high, the prices of most goods tend to go. Investors can practise investing in commodity markets through a futures or options contract. While a futures contract dictates individuals to sign a deed. Investors investing in commodities must be able to bear a total loss of their investment. • Speculative risks. The commodities markets, just like the bond or. Today, commodity trading forms the basis of the global trade ecosystem. Energy and metals are essential for manufacturing goods, and agricultural commodities. Commodity funds invest in raw materials or primary agricultural products, known as commodities. These funds invest in precious metals, such as gold and. Investing in physical commodities – a barrel of oil, a herd of cattle, or a bushel of wheat – is impractical for most, so investors tended to seek commodity. There are two main ways of investing in commodities: you can buy Exchange Traded Commodities (ETCs) or buy shares in companies which mine or produce the. Most investors decide to buy and sell commodities because they believe their price will change. Trading in commodities is very similar to buying other assets. Most investors decide to buy and sell commodities because they believe their price will change. Trading in commodities is very similar to buying other assets. Commodity futures markets present different risks than securities markets. For example, when individual investors or mutual funds buy shares in a company, they. Raw materials such as oil and gas, or wheat and cattle, or even gold and silver, are commodities that generally have relatively low correlations to stock and. Some actively managed ETFs are able to invest in commodity futures but avoid distributing K-1s to investors by holding futures contracts within Cayman Island. Every consumer has some indirect exposure to the commodities markets. Investors can consider futures contracts, options, and exchange-traded funds, but be aware. How to Trade Commodities Commodities can be traded as exchange-traded funds (ETFs), futures, and options. Traders can gain long, or bullish, exposure in.

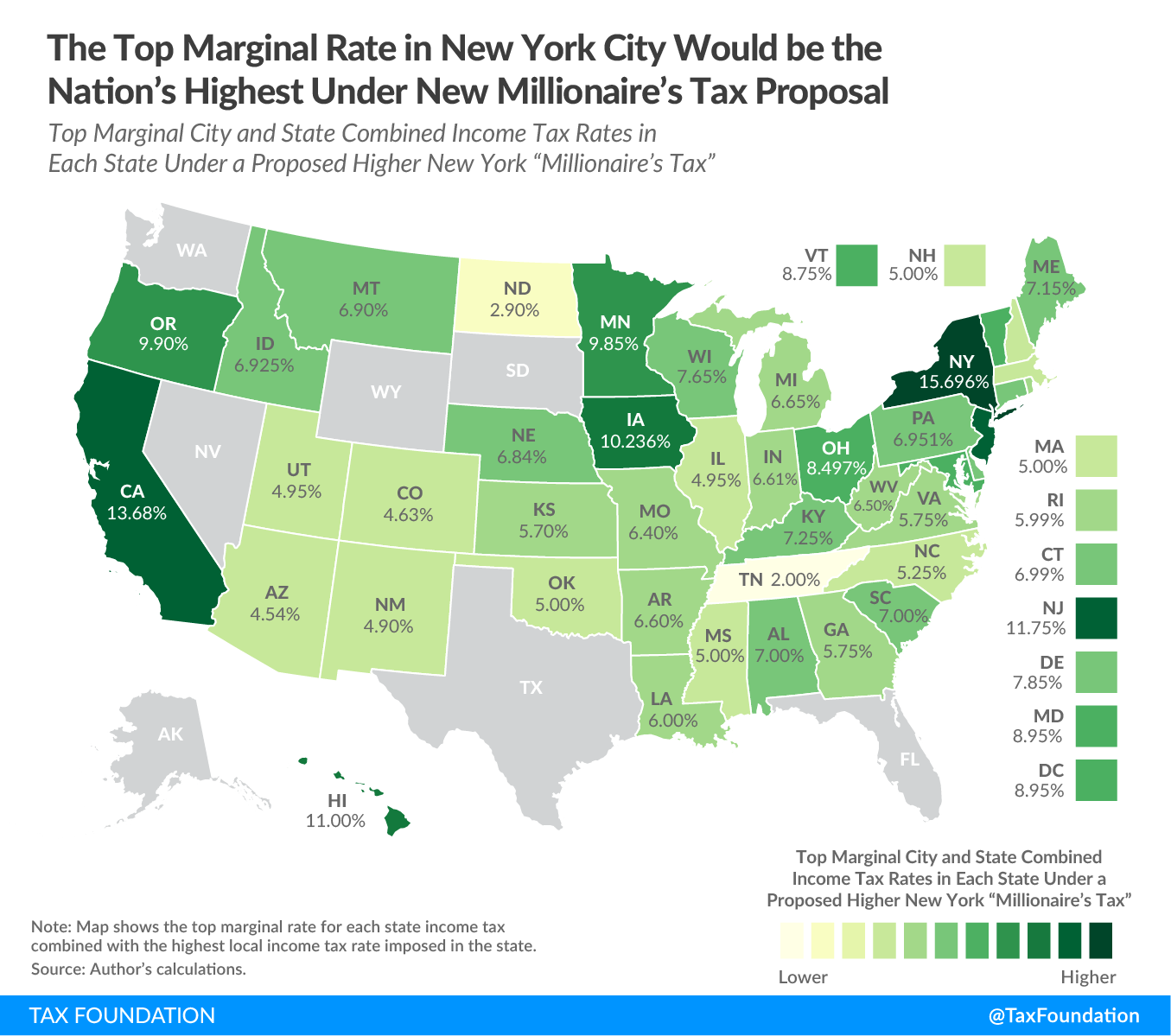

New York Income Tax Rate

income subject to tax in New York. With this change, the highest combined New York State and City tax rate on corporations is % (a. % New York State. The top New York estate tax rate is 16%. The New York estate tax is New York for New York income tax purposes. The second test is the statutory. Not over $14, % of NYC taxable income ; Over $14, but not over $30, $ plus % of excess over $14, ; Over $30, but not over $60, Welcome to FindLaw's Cases & Codes, a free source of state and federal court opinions, state laws, and the United States Code. Trusts offer many tools to shield trust assets from income taxation in New York. The following strategies may provide opportunities for your family to mitigate. State tax rates on personal income range from 4% to %. For the state fiscal year spanning and , New York collected $ billion in tax revenue. Tax bases and rates ; Type of Business, Rate in Tax Year and thereafter ; Cooperative housing corporations% ; All other corporations%. Business owners looking to start setting up a small business in New York will need to be aware of all the state taxes and regulations that come with setting up. gain for federal income tax purposes, forty percent of such amount. (31) The amount deducted or deferred from an employee's salary under a flexible benefits. income subject to tax in New York. With this change, the highest combined New York State and City tax rate on corporations is % (a. % New York State. The top New York estate tax rate is 16%. The New York estate tax is New York for New York income tax purposes. The second test is the statutory. Not over $14, % of NYC taxable income ; Over $14, but not over $30, $ plus % of excess over $14, ; Over $30, but not over $60, Welcome to FindLaw's Cases & Codes, a free source of state and federal court opinions, state laws, and the United States Code. Trusts offer many tools to shield trust assets from income taxation in New York. The following strategies may provide opportunities for your family to mitigate. State tax rates on personal income range from 4% to %. For the state fiscal year spanning and , New York collected $ billion in tax revenue. Tax bases and rates ; Type of Business, Rate in Tax Year and thereafter ; Cooperative housing corporations% ; All other corporations%. Business owners looking to start setting up a small business in New York will need to be aware of all the state taxes and regulations that come with setting up. gain for federal income tax purposes, forty percent of such amount. (31) The amount deducted or deferred from an employee's salary under a flexible benefits.

New York has a graduated state individual income tax, with rates ranging from percent to percent.

New York City income tax rates are %, %, % and % depending on your tax bracket and filing status. Remember that NYC income tax is in. Home · Government · Executive Departments (A-Z) · Assessment & Taxation Department; Tax Rate Information. Tax Rate Information. Tax Rate Per M NEW YORK STATE PERSONAL INCOME TAX UNDER ARTICLE 22 OF THE TAX LAW. ARTICLE 5 rate of New York State personal income tax on New York taxable income. UN Income Tax Unit, NYC and Tri-State Area State Tax Departments ; New York State Department of Taxation and Finance ; State of New Jersey, Department of the. The City Sales Tax rate is %, NY State Sales and use tax is 4% and the Metropolitan Commuter Transportation District surcharge of % for a total sales. The minimum combined sales tax rate for New York, New York is 8%. This is the total of state, county and city sales tax rates. State PIT liability after credits and average tax rates are also provided. Notes: The highest tax rate a filer's taxable income is subject to is the marginal. NYS Pension Taxation Requirements By State Will Your NYS Pension be Taxed If You Move to Another State? If you are considering moving to another state. Provides quarterly estimates of state and local government tax revenue at a national level, as well as detailed tax revenue data for individual states. For illustrative purposes only. Tax rates used at $K income level for married filing jointly: 35% Federal income tax rate, % Net Investment Income Tax . The New York (NY) state sales tax rate is currently 4%. Depending on local municipalities, the total tax rate can be as high as %. The County sales tax is collected by the State of New York. The current sales tax effective June 1, is % which is distributed as follows. The federal individual income tax accounted for $2,, or more than 70 percent, of the $3, difference between New York's federal taxes per capita and the. Home · Government · Executive Departments (A-Z) · Assessment & Taxation Department; Tax Rate Information. Tax Rate Information. Tax Rate Per M highest-earning 1 percent of New York taxpayers—whose effective income tax rates have increased sharply under the new federal tax law capping state and. County Tax Rates · School District Tax Rates – · School District Tax Rates – · Special District Tax Rates · State Equalization Rates · Tax. New York paycheck calculator. Payroll Tax · Salary Paycheck Calculator; New York Paycheck Calculator. Use ADP's New. % to %, depending on an employee's income level. There is also a supplemental withholding rate of % for bonuses and commissions. In New York state, an. The County sales tax is collected by the State of New York. The current sales tax is % which is distributed as follows.

Crypto Futures Exchange

Cryptocurrency futures allow you to trade on your view of the price and future performance of two leading cryptocurrencies: Bitcoin and Ether. Bitget's perpetual and delivery futures provide users with sufficient liquidity to help users explore futures trading in depth. Best crypto futures trading platform in the US with leverage? · Phemex: Known for % fee for spot trading and up to x leverage on futures. Looking for a cryptocurrency exchange to buy, sell, and exchange crypto futures trading. Pros & Cons. Pros. Large number of supported cryptocurrencies. Can I trade Futures on Nexo? · Head to your USDT Wallet and transfer your USDT to your Futures Wallet at no cost. · Tap the Exchange button on your dashboard. BYDFi is recognized as the best crypto futures exchange overall in our list, offering a user-friendly interface, robust security measures, and a diverse range. The top crypto derivatives exchanges are Binance, Huobi Global, ByBit, OKEx and Bitmex. The biggest crypto derivatives exchange is Binance. A crypto futures contract is an agreement between two parties to exchange the fiat-equivalent value of a cryptoasset, or the asset itself, on a future date. Enjoy the power of the Deribit cryptocurrency exchange at your fingertips. Trade options, futures, and perpetuals on the go. Download the Deribit app now! Cryptocurrency futures allow you to trade on your view of the price and future performance of two leading cryptocurrencies: Bitcoin and Ether. Bitget's perpetual and delivery futures provide users with sufficient liquidity to help users explore futures trading in depth. Best crypto futures trading platform in the US with leverage? · Phemex: Known for % fee for spot trading and up to x leverage on futures. Looking for a cryptocurrency exchange to buy, sell, and exchange crypto futures trading. Pros & Cons. Pros. Large number of supported cryptocurrencies. Can I trade Futures on Nexo? · Head to your USDT Wallet and transfer your USDT to your Futures Wallet at no cost. · Tap the Exchange button on your dashboard. BYDFi is recognized as the best crypto futures exchange overall in our list, offering a user-friendly interface, robust security measures, and a diverse range. The top crypto derivatives exchanges are Binance, Huobi Global, ByBit, OKEx and Bitmex. The biggest crypto derivatives exchange is Binance. A crypto futures contract is an agreement between two parties to exchange the fiat-equivalent value of a cryptoasset, or the asset itself, on a future date. Enjoy the power of the Deribit cryptocurrency exchange at your fingertips. Trade options, futures, and perpetuals on the go. Download the Deribit app now!

Top Derivative Exchanges Ranked by Open Interest & Trade Volume ; AscendEX (BitMax) (Futures). Cash ; HashKey Global (Futures) ; Refine your trading with options. Cryptocurrency options on futures offer around-the-clock liquidity, market depth, and extensive product choice on the world's. A futures contract is an investment product, a financial derivative that allows traders to profit from the performance of an underlying asset. A perpetual contract is similar to a crypto futures contract with one key difference - there is no expiry date. Traders can hold a position open as long as. Crypto futures trading helps you gain price exposure to a wide range of assets. Create a free Kraken Futures account, an advanced crypto futures exchange. Binance Futures - The world's largest crypto derivatives exchange. Open an account in under 30 seconds to start crypto futures trading. KuCoin Futures is a powerful and safe crypto derivatives trading platform. Create an account in a few mins and start your crypto trading right away! A Bitcoin futures contract is a standardized agreement to buy or sell a specific quantity of Bitcoin at a specified price on a particular date in the future. In. The Chicago Mercantile Exchange Inc. (CME) and the CBOE Futures Exchange (CFE) self-certified new contracts for bitcoin futures products and the Cantor. Futures are a derivatives tool traders can find on crypto exchanges. Here we explain what they are and how futures work in the crypto market. A new kind of derivatives exchange. We are focused on creating accessible markets and innovative products built for institutional and retail traders. Futures products and services on Coinbase Advanced are offered by Coinbase Financial Markets, a member of NFA and is subject to NFA's regulatory oversight. After the successful launch of the FTSE Bitcoin Index Futures and Options Eurex has launched the extension of its crypto derivatives portfolio, together with. CoinDCX Futures - Start Crypto Futures Trading in India with high liquidity, 15X leverage & low fees on Bitcoin & Altcoin Futures pairs | Available on. Binance Futures - The world's largest crypto derivatives exchange. Open an account in under 30 seconds to start crypto futures trading. Globally trusted Crypto Derivatives Exchange to trade futures, options, and perpetual contracts. Trade with confidence at low fees and with up to x. The main idea of futures trading is quality price prediction and “betting” on future coin rates. To trade crypto futures, you need to conduct thorough research. This article will provide deeper insights into the top crypto futures exchanges to help you make an informed choice. More choices to manage cryptocurrency exposure · Ether futures · Micro Ether futures and options · Bitcoin Euro futures · Micro Bitcoin futures and options.

Get Credit For Rent

However, with RentRedi, you can now report your on-time rent payments to credit bureaus as well! With rent being a large monthly payment, you can increase your. Kikoff can help you boost your credit with the rent you already pay. That's right! No heavy lifting for you. Get started. Join over a million users who signed. If you regularly pay your rent on time and in full, you can have your good payment history reported to credit bureaus to help raise your credit score. Although chances are small you will recover the owed rent payment(s), the collection account will show up on the tenant's credit report and have a significant. Rent Reporting, powered by Buildium, allows property managers to offer their residents an easy, effective, and affordable way to build their credit history. Residents who report their rent payments to TransUnion are going from credit invisible to being able to get loans for automobiles or mortgages. It's finally. One way to build credit is with rent payment reporting. That's the practice of reporting an individual's monthly rent payments to credit bureaus or credit. Report your rent payments to a credit bureau through Avail. Easily build Get Support. Contact UsHelp Center() 1 S Wacker Dr Fl 26, Ste. Report rent to credit bureaus with FrontLobby. Get access to tenant screening, credit building, & debt reporting. However, with RentRedi, you can now report your on-time rent payments to credit bureaus as well! With rent being a large monthly payment, you can increase your. Kikoff can help you boost your credit with the rent you already pay. That's right! No heavy lifting for you. Get started. Join over a million users who signed. If you regularly pay your rent on time and in full, you can have your good payment history reported to credit bureaus to help raise your credit score. Although chances are small you will recover the owed rent payment(s), the collection account will show up on the tenant's credit report and have a significant. Rent Reporting, powered by Buildium, allows property managers to offer their residents an easy, effective, and affordable way to build their credit history. Residents who report their rent payments to TransUnion are going from credit invisible to being able to get loans for automobiles or mortgages. It's finally. One way to build credit is with rent payment reporting. That's the practice of reporting an individual's monthly rent payments to credit bureaus or credit. Report your rent payments to a credit bureau through Avail. Easily build Get Support. Contact UsHelp Center() 1 S Wacker Dr Fl 26, Ste. Report rent to credit bureaus with FrontLobby. Get access to tenant screening, credit building, & debt reporting.

When you pay your rent on time, this data is reported to. Experian RentBureau and incorporated into your Experian credit report. What type of rental payment. Your rent payments can now help raise your credit score through Experian Boost. Rent will now also be counted among other positive payment info such as. When you apply for a credit card they ask to know your income before they approve you for X amount of dollars. If that same credit card company. Paying your rent on time and in full each month can help you establish and build good credit, but credit bureaus do not always receive the information needed to. We report your rent payment history to the credit bureaus which will boost your score in as little as 10 days. It will appear on your credit report, as “RR/. The Program is an innovative housing solution and pilot program that aims to help credit-invisible renters and renters with weak credit potentially build. Paying rent can help you build your credit score if you pay on time. Some landlords report rent payments to a rent-reporting service, while others do not. If your property manager uses RentTrack, you can report your rent payments to the three major credit bureaus, allowing you to build credit using the payments. Unfortunately, they do not get credit for it, even if they have never missed a payment or paid late. All of that is about to change. The major credit bureaus. What is rent reporting? Rent reporting means using a third-party service to get your rent payments reported to the credit bureaus, Equifax, Experian, and. New reporting services can help get rent payments applied to building good credit. For too long residents have begged the question: If my utility bills and. Rent reporting is a powerful tool that helps Tenants build their credit score and gain access to financial opportunities. By reporting rental payments. Low-income Tenants Can Get “Credit” for Paying their Rent - Experian supports the launch of CBA's Rent Reporting Technical Assistance Center. Adding your rental payments and utility payments to your credit reports is favorable to your credit health. Apply any of the methods discussed above to share. Helping landlords and property managers provide opt-in programs that give tenants the option to let their landlord report rent payment information to credit. Rent reporting is a powerful tool that helps Tenants build their credit score and gain access to financial opportunities. By reporting rental payments. When you apply for a credit card they ask to know your income before they approve you for X amount of dollars. If that same credit card company. Rent Reporting: You may need your landlord's permission to paint your room, but you don't need it to get credit for paying your rent. · Utility Reporting. Once you subscribe to Rent Reporting, TurboTenant will automatically report your on-time rent payments to TransUnion, helping you get the credit score you. Your best bet to avoid damaging your credit is to negotiate an amendment to the terms of your lease or rental agreement, getting your landlord to agree to.

Perpetual Inventory Definition

What is a Perpetual Inventory System? Perpetual inventory system definition: the perpetual inventory system (AKA continuous inventory system) is a method of. Definition. A perpetual inventory system is a method of inventory management that continuously updates inventory records in real-time as purchases and sales. The perpetual inventory system involves tracking and updating inventory records after every transaction of goods received or sold through the use of technology. Perpetual inventory updates the quantities continuously and periodic inventory updates the amount only at specific times, such as year end. Perpetual inventory. A perpetual inventory system is a method of tracking inventory that uses a central database to maintain real-time, up-to-date inventory records. It's simply a. PERPETUAL INVENTORY definition: → continuous inventory. Learn more. Perpetual stock management – also known as perpetual stock taking or perpetual inventory system – is a type of inventory valuation whereby a business uses. Perpetual inventory is the accounting practice of continuously maintaining inventory records in real time without counting stock levels by hand. In the words of. Under a perpetual inventory system, updates are made continuously – every time a product is sold, bought or manufactured. The same goes for returns; the. What is a Perpetual Inventory System? Perpetual inventory system definition: the perpetual inventory system (AKA continuous inventory system) is a method of. Definition. A perpetual inventory system is a method of inventory management that continuously updates inventory records in real-time as purchases and sales. The perpetual inventory system involves tracking and updating inventory records after every transaction of goods received or sold through the use of technology. Perpetual inventory updates the quantities continuously and periodic inventory updates the amount only at specific times, such as year end. Perpetual inventory. A perpetual inventory system is a method of tracking inventory that uses a central database to maintain real-time, up-to-date inventory records. It's simply a. PERPETUAL INVENTORY definition: → continuous inventory. Learn more. Perpetual stock management – also known as perpetual stock taking or perpetual inventory system – is a type of inventory valuation whereby a business uses. Perpetual inventory is the accounting practice of continuously maintaining inventory records in real time without counting stock levels by hand. In the words of. Under a perpetual inventory system, updates are made continuously – every time a product is sold, bought or manufactured. The same goes for returns; the.

Perpetual Inventory Definition The perpetual inventory method is a way of accounting for inventory that records the purchase and sale of products. And it does. perpetual system of inventory definition and meaning. Define perpetual inventory. perpetual inventory synonyms, perpetual inventory pronunciation, perpetual inventory translation, English dictionary definition. Define Perpetual inventory. means an ongoing system for recording quantities of drugs received, dispensed, or otherwise distributed by a pharmacy. A perpetual inventory system is a computerized system that keeps track of the quantity of inventory on hand and updates the records as goods are purchased or. Perpetual inventory is a system in which the book inventory of the business is kept up to date to the actual inventory of the business. In this system, the. The meaning of PERPETUAL INVENTORY is a book record of inventory kept continuously up to date by detailed entries for all incoming and outgoing items. Perpetual inventory system is an inventory management technique that enables continuous tracking and real-time updates of inventory levels. Perpetual inventory definition: a form of stock control in which running records are kept of all acquisitions and disposals. See examples of PERPETUAL. Businesses may use two systems to maintain inventory records: perpetual and periodic. Now that computing systems that tie inventory and sales records. Because perpetual inventory systems provide real-time tracking of sales and inventory levels for specific items and help to prevent stockouts, they may be. Perpetual inventory is a method of accounting for products and stock by using a computer system or software that automatically keeps count of available stock. The perpetual inventory system gives them real-time visibility into their stock levels, enabling them to make informed decisions about purchasing, sales, and. With a perpetual inventory system, the inventory record for each item of inventory is updated for each purchase and each sale as it occurs. The actual cost of. A perpetual inventory system is an inventory management method that records each sale or purchase of inventory in real-time, through automated software. Perpetual Inventory Definition | TLDR Perpetual inventory is an inventory management method where the quantity and status of items in stock are continuously. PERPETUAL INVENTORY is an inventory accounting system whereby book inventory is kept in continuous agreement with stock on hand. The notion of perpetual inventory refers to a system, or in practice a software, where the information on the inventory quantity and availability of SKUs. Perpetual inventory, also known as continuous inventory, is a real-time system that continuously tracks inventory levels, recording every transaction as it. A perpetual inventory system is an accounting method that continuously updates inventory records in real-time, tracking changes in inventory levels as purchases.

Get A Mortgage Now

Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. Climate-related disasters have been dominating headlines for years now There are fewer places left where Canadians can get holistic mortgage and financial. View today's mortgage rates for fixed and adjustable-rate loans. Get a custom rate based on your purchase price, down payment amount and ZIP code and. Before you get started shopping for a home, it makes sense to know the current mortgage rates. After all, your rate will dictate how much interest you can. Compare USAA mortgage rates and let us help you find the right type of mortgage for your home loan needs. View today's rates now and get preapproved online. Despite rising interest rates, now is still a good time to buy a home. You How to get a mortgage · Mortgage preapproval · Mortgage calculator. Home. Compare today's mortgage rates and get a customized quote from a lender that fits your needs. To qualify for a mortgage, you must demonstrate that you are at low risk of forfeiting on your monthly payments. It is also important to have enough in the bank. The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms. Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. Climate-related disasters have been dominating headlines for years now There are fewer places left where Canadians can get holistic mortgage and financial. View today's mortgage rates for fixed and adjustable-rate loans. Get a custom rate based on your purchase price, down payment amount and ZIP code and. Before you get started shopping for a home, it makes sense to know the current mortgage rates. After all, your rate will dictate how much interest you can. Compare USAA mortgage rates and let us help you find the right type of mortgage for your home loan needs. View today's rates now and get preapproved online. Despite rising interest rates, now is still a good time to buy a home. You How to get a mortgage · Mortgage preapproval · Mortgage calculator. Home. Compare today's mortgage rates and get a customized quote from a lender that fits your needs. To qualify for a mortgage, you must demonstrate that you are at low risk of forfeiting on your monthly payments. It is also important to have enough in the bank. The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms.

If the home turns out to need major repairs or renovations, it may be tough to obtain a home equity loan or mortgage. You don't know what your credit score will. So let's say you buy for , A year from now prices go up and your home is worth , That equity is yours and would help you loan to. You never know what you're going to get on the days surrounding a 3 day Today's Mortgage Rates Mortgage Calculator · Rates · Mortgage Rates · Mortgage. Today's mortgage rates. Mortgage rates change every day. If you see a rate that works for you, start your application. View today's mortgage rates and trends on Forbes Advisor. Compare current mortgage rates and APRs to find the loan that best suits your financial situation. To get pre-approved, you will start by submitting a mortgage application. A loan officer will look at your credit history, income, assets, debts, etc. The. Mortgage rates can vary significantly between lenders and regions. By taking the time to compare mortgage rates, you put yourself in a prime position to find. We're excited to offer our customers a fast and simple way to apply and qualify for a home loan with our new online application process. Apply Now*. Still have. Your mortgage rate determines the overall cost of borrowing to purchase real estate — and how much home you can afford to buy — so shopping around for the best. During the pandemic, mortgage rates plummeted below 3%, flooding the real estate market with homebuyers trying to snag a good rate. Craziness ensued. People. Find and compare year mortgage rates and choose your preferred lender. Check rates today to learn more about the latest year mortgage rates. View rates, learn about mortgage types and use mortgage calculators to help find the loan right for you. Prequalify or apply for your mortgage in minutes. Mortgage Now is a locally-owned business in Jacksonville, Florida, dedicated to assisting first-time home buyers, homeowners, and realtors. No as that the only reason 1st mortgage rates are not near as important as the cost of the home. Many homes are way over valued currently. Get Free Rate Quote And Closing Cost Analysis! · Are you a real estate investor or self-employed? Click here > to get out of debt or hard money loans! · Do you. Here are today's mortgage rates in. Take the next step by getting a personalized quote in as quick as 3 minutes with no impact to your credit score. It is nearly impossible to buy a house with only 2x - 3x of your salary unless you really make a lot. I wonder is it a rumor or a fact? Keep reading to learn how to get the best mortgage rate in Canada. Today's lowest mortgage rates in: Select a province. All of Canada. Learn how the Rocket Mortgage process works and get approved online to buy a home or refinance your mortgage Take advantage now - Apply today! In an ideal world, you'd buy when both house prices and mortgage rates reach a low point. But it's unlikely you'd time the market perfectly, so you need to.